This article is about business licensing, an important factor to consider when starting a business. It's important to know the legal responsibilities you have as a new business owner as well as the tax advantages of forming under different business structures.

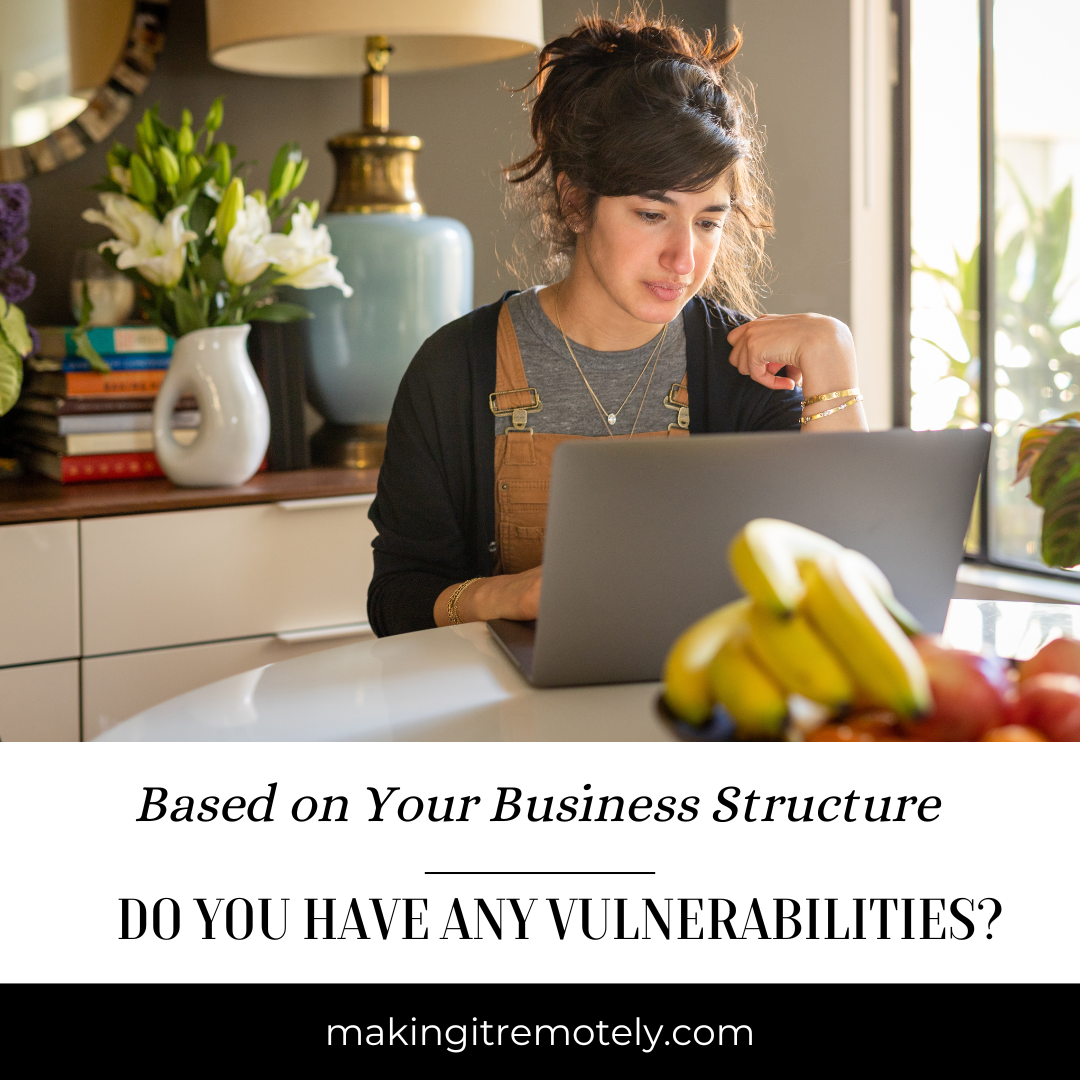

You might be thinking that you can hum along with your business without a license. But what happens if for whatever reason, one of your customers or employees feels that they have been harmed in some way.

Will your personal assets, like your home, bank account or other resources be in jeopardy if someone sues you? It depends on the business structure you have selected for your business.

Filing the right business license ensures that you address any vulnerabilities that can leave your assets subject to any legal action taken against your business.

There are various protections that certain business structures can offer you so that your personal assets can be kept separate from your business assets. You'll also discover the permits and licenses you'll need to operate your business from home.

At the same time, filing the necessary legal paperwork, (for example, accessing the right documents and knowing which forms to file) can seem overwhelming and costly, unless you have the right tools and resources available.

So this tutorial will also show you the difference between running your business as a sole proprietor and forming an LLC. You'll also learn about terms and various business structures that are available.

You'll also learn why it's important to find out if your business name is available to ensure that you're the only one in your that is legally able to use that name.

What is a Business License?

A business license authorizes a company to “do business” in a certain geographical jurisdiction. It is a certificate that shows your company is properly registered with the particular county or city in which your office(s) are located.

How to Get Started

Sole proprietorships and limited liability companies (LLCs) are two of the most common business structures for individuals and small businesses. This article discusses the most common ways to get started with a business (full time or side hustle) and the advantages of each.

First you'll need to know if the name you want for your company is available. To find out if your business name is available, check here.

Next we'll introduce you to Bizee (formerly IncFile), a company that helps entrepreneurs simplify the process of starting a business, saving them time and effort, and giving them peace of mind.

Once you know that your business name is available it's important to file the proper paperwork to make sure you can use that name under your legal business structure.

Every business is different so next, we'll explain the terms and structures you should be familiar with to register under the structure that works best for your unique needs.

Short on Time? Here's a Quick Video Summary

What is Bizee?

Bizee is a platform that provides business licensing services to entrepreneurs. They assist in the process of starting a business by offering services such as registering the company, obtaining an EIN number, and creating a customized LLC operating agreement.

Bizee (formerly known as Incfile) is a top rated service with the best value for those who are just starting out.

For example, their Silver package helps you register an LLC for $0 + the fees charged by your state. It includes the following:

- State fee + $0 Package fee

- Preparing & Filing the Articles of Organization

- Unlimited Name Searches

- Access to Your Own Business Dashboard

- FREE Registered Agent Service for a year!

- Unlimited Phone & Email Support

To learn more about the Gold and Platinum packages, check here.

Bizee provides business licensing services to creative and handmade entrepreneurs. They assist in the process of starting a business by offering important business services at an affordable prices.

They handle services like registering a company, assisting in obtaining an EIN number, and creating a customized LLC operating agreement. Bizee (formerly known as Incfile) is known as a top rated service with the best value for those who are just starting out.

For example, their Silver package helps you register an LLC for $0 + the fees charged by your state. It includes the following:

- State fee + $0 Package fee

- Preparing & Filing the Articles of Organization

- Unlimited Name Searches

- Access to Your Own Business Dashboard

- FREE Registered Agent Service for a year!

- Unlimited Phone & Email Support

To learn more about the Gold and Platinum packages, check here. Bizee helps entrepreneurs simplify the process of starting a business, saving them time and effort, and giving them peace of mind.

What is a Registered Agent?

All formal business entities, such as an LLC or Corporation, must have a registered agent.

A registered agent is a person or service who will receive legal documents on behalf of your business, such as subpoenas, regulatory and tax notices, and correspondence.

In many states, lawsuits must be served in person. Having a registered agent makes this a clear and orderly process.

In general, your agent can be any person who:

- Is at least 18 years old

- Has street address within the state

- Is physically present at that address during business hours

Your registered agent can also be a company registered with your state to provide registered agent services. Your business cannot act as its own agent.

Your registered agent's name and address are publicly available, so outsiders know who to deliver papers. And you can feel confident that there's just one contact point for any legal notices your business might receive.

Once you've chosen a registered agent, you can tell the agent who to notify if they receive lawsuits or other documents.

The agent's role sounds simple, but lawsuits, subpoenas, and notices tend to have strict deadlines. Missed deadlines can have both legal and financial consequences.

As a result, it's critical to have an agent who is responsible and can be trusted to pass along information promptly.

How to Purchase Business Licensing Services

Use the links below from Bizee to obtain and maintain a business license that allows you to operate legally in your locale.

They make it easy to obtain services with packages like the business license research package, registered agent, filing an annual report and more. They even provide virtual address and mailing services.

-

Get a Federal Employer Identification Number EIN/Tax ID Number

$70.00 Purchase Product -

File Articles of Amendment for a Company Name Change

$99.00 Purchase Product -

Corporate Business Formation Kit for an LLC

$99.00 Purchase Product -

Virtual Address and Mail Scanning Service

$29.00 Purchase Product -

File an Order of Reinstatement

$199.00 Add to cart

The Business Dashboard

When you work with Bizee, you will receive a business dashboard that comes with the following:

Things to Do Before Turning Your Side Hustle Into a Reality

When you determine it's finally time to turn your side hustle into your full-time job, there will be a long to-do list. With some organization, planning and a little extra work, you can make the transition with grace.

Check the Requirements for Home Based Businesses

For your home business to operate legally, you’ll need to have the necessary licenses and permits. Check here for information on what you'll need to operate legally from home.

Without them, the repercussions could include fines and penalties, or your company could be shut down completely. So whether your home-based business is a side gig or a full-time operation, let's determine which home business licenses and permits your company needs.

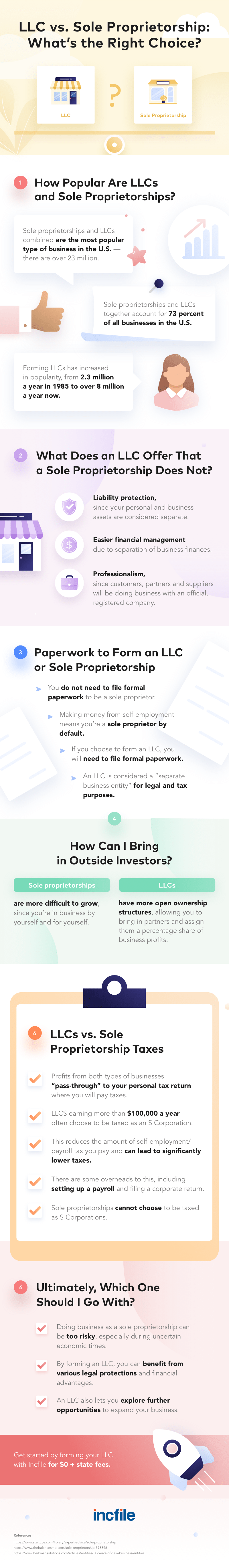

A sole proprietorship is the simplest and requires minimal paperwork. An LLC requires upfront paperwork and costs but could provide your business long-term benefits that make the investment worth it.

Legal protection and potential tax advantages are two big factors to consider when choosing between a sole proprietorship and an LLC.

What Is a Sole Proprietorship?

A sole proprietorship is an unincorporated business that’s owned by the individual running it. A sole proprietorship is the default choice for anyone who runs a business but hasn’t set up another formal business structure like an LLC.

As a sole proprietor, there is no separation between your personal and business assets and expenses. You are personally responsible for all your business’s debts and obligations.

A sole proprietorship can only have one owner. If you take on a business partner, your unincorporated business will become a general partnership.

Individuals that do a lot of contractual work, such as freelancers, consultants and personal trainers often choose to file their taxes as sole proprietors.

This is the easiest way to go if you’re just starting out or you’re not yet making enough profit to justify the costs of an LLC.

However, even if you’ve been in business for decades, a sole proprietorship may still be the best option, depending on the type of business you run.

It’s all going to depend on your income, business type and your personal management preferences.

What Is a Limited Liability Company (LLC) and What are the Requirements for Each State?

An LLC is a limited liability company which means its members are not personally liable for the company's debts.

LLCs are taxed on a pass-through basis — all profits and losses are filed through the member's personal tax return.

The requirements for forming LLCs vary by state. To learn about the requirements for forming an LLC in your state, click here.

Here are some other interesting facts about LLCs:

An LLC is a business entity that’s created by filing paperwork with your state. An LLC can have one owner (known as a “member”) or many owners.

Once formed, an LLC has its own legal identity that’s separate from you, the owner.

Because of this, a business creditor cannot legally go after your personal assets if your business is sued or unable to pay its debts.

Additionally, an LLC’s bankruptcy is considered separate from the owner’s. If you have employees, an LLC can also help shield you from liability for your employees’ actions.

By default, single-member LLCs are taxed in the same way as sole proprietorships. But an LLC can also elect to be taxed as an S Corporation or a C corporation.

This tax flexibility allows LLC owners to choose the most cost-effective tax structure for their particular business. For some businesses, the corporate taxation option is a major reason to form an LLC.

When Should You Open an LLC?

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective.

This varies by state and the type of business, so it’s a good idea to speak to your accountant and compare the taxes you’ll be paying with each business structure.

Steps to Take Once You've Formed an LLC

Get an employer ID Number and set up a business bank account for your business. This is an important step in creating a separate identity for your business and it gives you a place to keep your business income away from your personal banking. It also gives you a way to get paid in the name of your business.

Running Your Business as a Sole Proprietorship versus Running It as an LLC

There are a few distinctions in operating a business as a sole proprietorship vs. an LLC. As a sole proprietor, there’s no separation between you and your business. You’re not obligated to separate your personal and business bank accounts and credit cards.

However, opening up a different checking account for your business will make it easier to identify business expenses when it comes time to file your taxes.

With an LLC, it’s important to keep your business finances completely separate from your personal ones. You’ll need a business bank account, and you’ll sign documents and contracts on behalf of the business, not as yourself personally.

Separating your personal and business finances makes it easier to protect your personal assets from some of the worst case scenarios of being in business. This is a big factor to consider when deciding on whether to form an LLC or work as a sole proprietor.

Working as a sole proprietor leaves your personal unprotected in the event of a lawsuit.

Keeping things separate preserves your liability protection because it shows that the LLC truly has its own separate identity.

Tax Implications for Each Business Structure

For tax purposes, an LLC offers more options than a sole proprietorship. All sole proprietors are self-employed. You’ll list your business income and expenses on Schedule C of your personal tax return and you’ll pay personal income tax on your profits.

You’ll also be responsible for paying your own Social Security and Medicare taxes, otherwise known as “self-employment taxes.”

Single-member LLC owners are automatically treated like self-employed sole proprietors for tax purposes. But an LLC can also elect to be taxed as a corporation. With corporate taxation, an LLC owner can be an employee of the company rather than being self-employed.

Some business owners find that taxation as an S corp saves on self-employment taxes and enables them to put away more for retirement.

If your solo business is starting to make a significant profit, talk to an experienced accountant about the best tax status for your company.

Finally, some people choose to open up an LLC because it gives their business a sense of legitimacy. You’d be operating your business as a company, send payments from the company, and your clients will see the “LLC in your company name.

With an LLC, you’ll also be able to establish business credit in a way that you couldn’t with a sole proprietorship.

A Sole Proprietorship vs. An LLC: Formation and Registration Costs

Whether you choose a sole proprietorship or an LLC, the formation process and its associated costs will largely depend on your state.

For a more detailed look at what you can expect on the LLC side, you can check out our business entity comparison.

It's important to set your company up for success. And knowing which business structure is best for your unique situation will leave you informed and confident that your business could withstand any legal issues.

At a minimum, you'll want to make sure your business name is available and do a business name search. Start out by filing the right paperwork and forming the legal structure that is best for you.

This Infographic Sums It All Up

Make Your Business Legal

Start a Limited Liability Company Today with Bizee (formerly knowns as IncFile)

Bizee makes minimizing your risk easy and affordable. Click the button below to get started.